First of all, we want to wish you a happy new year!

We hope your 2021 is going great and that all the amazing plans and dreams you have for this year all manifest in abundance.

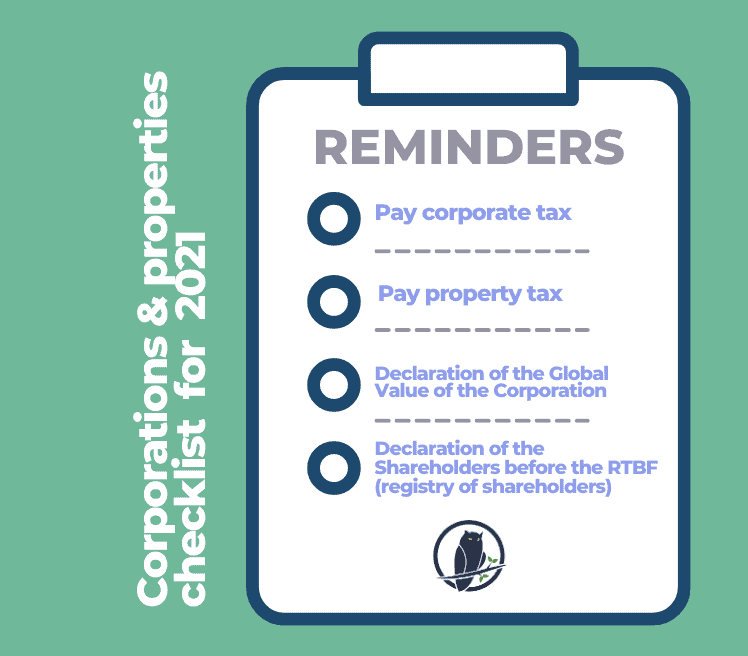

This is a super friendly reminder of all the duties you as a business, property owner, or corporation have in this first trimester.

CORPORATION & PROPERTY CHECKLIST FOR 2021

Pay yearly Corporate Taxes

Due in January

In case you have a corporation this is a yearly payment that can be easily completed through your BCR account. We at LAW Xperts can also assist you in this matter.

Declaration of the corporation’s shareholders

Due by April

This new regulation requires you to present the Declaration of the Shareholders before the RBTF (Registry of Shareholders). This requirement is for all corporations.

For more information regarding this regulation click on this link and visit our blog post.

Pay your Property’s Tax

Due once a year or by trimester

If you, on the other hand, own a property in Costa Rica, you need to pay this tax once every year or every 3 months depending on what works best for you.

Declaration of the Global Value of the Company

Due by March 15th

If your corporation holds any assets such as property, the Declaration of the Global Value of the Company (D-135) needs to be presented by March 15th in order to avoid monthly fines.

Visit our blog post on Tax Regulations and get all the information you need.

If you need any assistance in these processes we will be more than glad to help you.

We’re just an email away! Contact us at nicole.quesada@lawxpertscr.com